Empowering Your Dreams, One Step at a Time

Whether you’re saving for the future, planning your next big move, or in need of quick financial support, Bloc Microfinance Bank is here to make it happen—easily, securely, and affordably.

We are licensed by

and insured by

Bank With Bloc Microfinance Bank

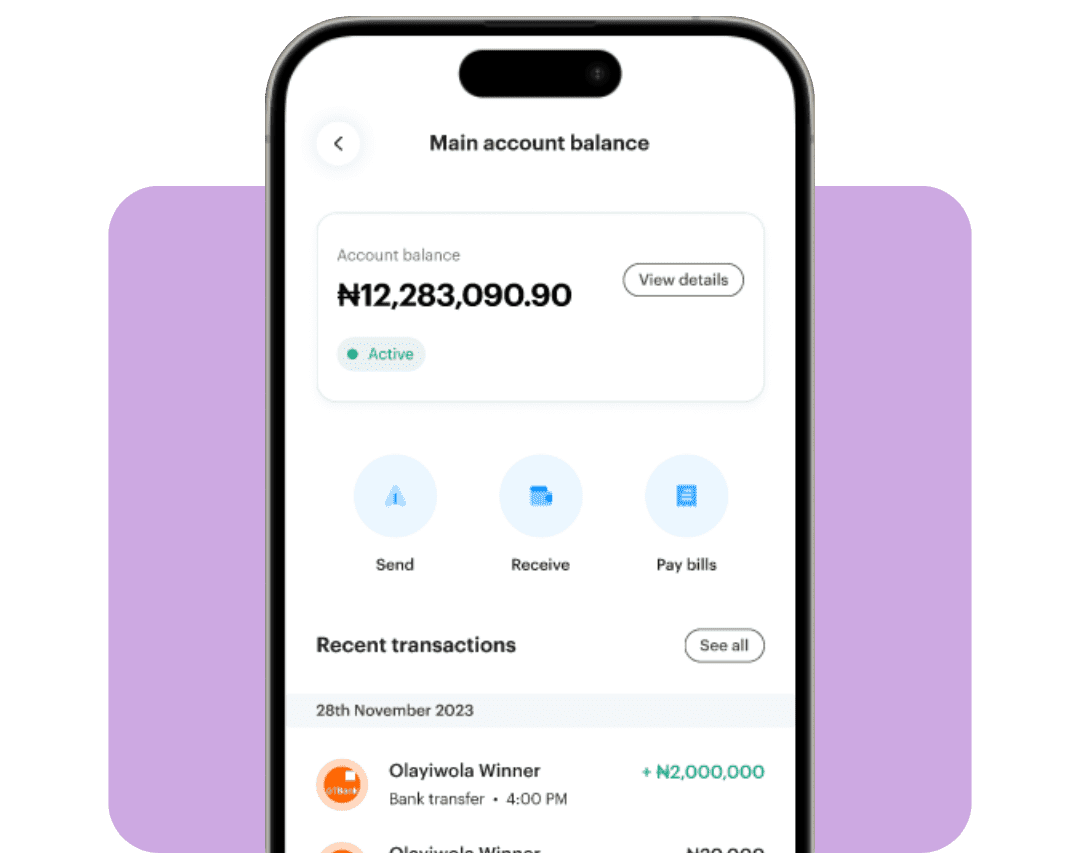

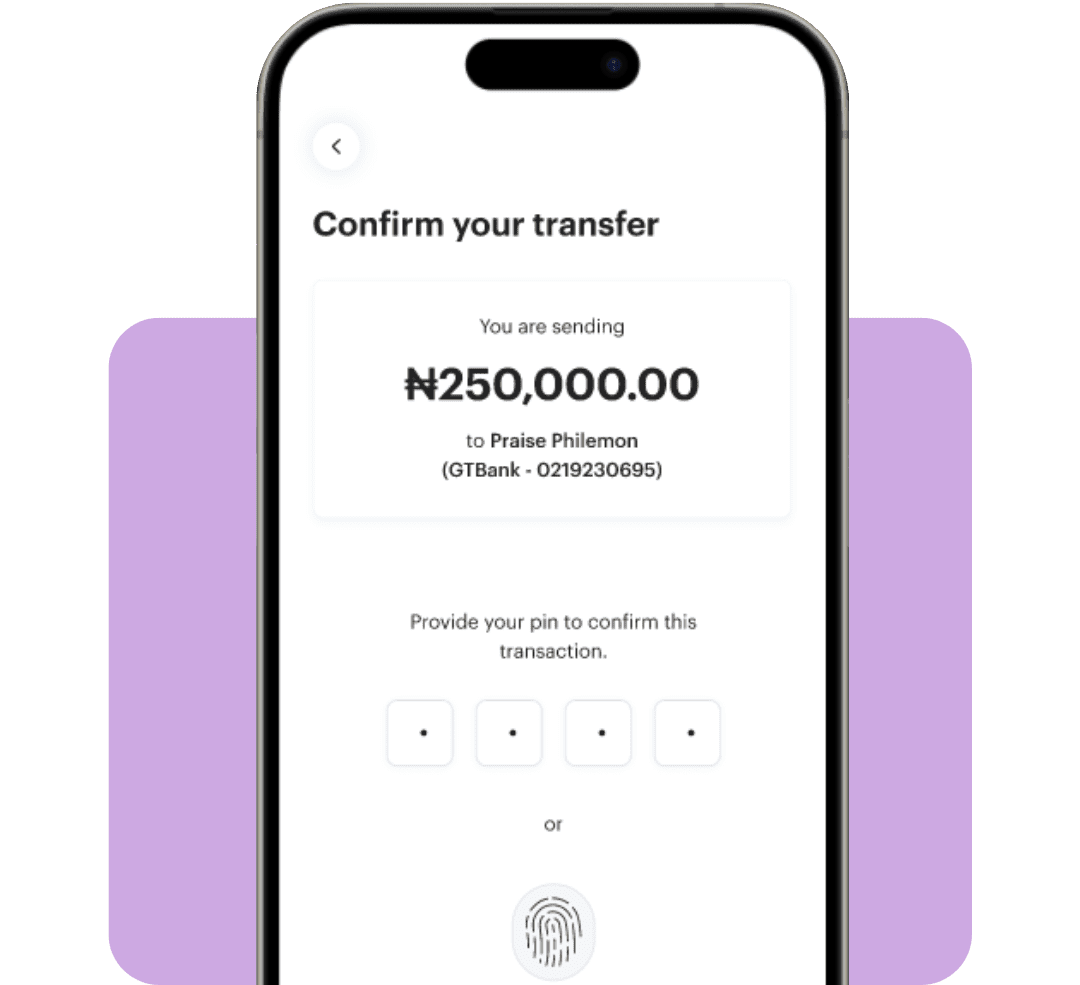

Experience 99.9% transfer success rate and effortless payment transfers. Whether you’re paying bills, sending money to a friend, or making a business payment, Bloc MFB ensures your transfers are successful every time. We guarantee it.

All-in-One Banking App for Your Financial Needs

Looking for a simple way to manage your money? We understand how important your finances are. With our app, you can manage your money, make payments, and pay bills—all in one place.

Get Debit Cards That Always Work—Instantly!

Prefer cards over transfers? No problem. Request your debit card today, and we’ll deliver it to your doorstep within 48 hours. Activate it in minutes and start using it immediately.

Effortless Transactions, Every Time

Send money to loved ones, top up airtime, and pay bills without a hitch. With Moniepoint, your transactions are smooth, reliable, and hassle-free!

Even More Benefits

Enjoy even more essential services on Bloc MFB

Insurance for Your Peace of Mind

Rest assured, your funds are protected. With coverage of up to ₦250,000 by the Nigerian Deposit Insurance Corporation, your money is in safe hands.

Cutting-Edge Security You Can Trust

Your safety comes first. Bloc MFB leverages advanced cybersecurity technology to safeguard your information and prevent unauthorized access.

Secure Shopping Made Simple

Shop online with confidence using our virtual card feature, ensuring your actual card details stay protected.

24/7 Support, Just for You

We’re here whenever you need us. Reach out to our support team by phone, email, in-app chat, or visit our Help Center for quick assistance.

Simple Limit Upgrade

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Always Online, Always Reliable

Enjoy seamless transactions every time with a banking solution you can trust—say goodbye to downtimes and pay anywhere with confidence.

Get Started in Just 7 Minutes

Enter your email and phone number, then verify your phone number with an OTP for quick and secure setup.

Choose a username and password, provide your BVN and KYC details, and complete face and ID verification. Once done, set up a PIN to manage your account with ease.

Click "Add Money" to view your account details and top up your balance. Start making transfers instantly.

Order your debit card from the Card menu, and have it delivered to you within 48 hours.

Blogs & Articles

Stay updated with the latest changes and value rich content on our blog

Frequently Asked Questions.

Personal banking refers to financial services and products designed specifically for individuals. These include savings accounts, loans, and other services tailored to help you manage your personal finances effectively.

To open an account, all you need is a valid Nigerian phone number, a functional email address, and your BVN. These will grant you access to a functional bank account at KYC Level 1. Click here to learn more about the KYC levels.

No, there are no fees for opening or maintaining an account with Bloc MFB.

Absolutely! At Bloc MFB, we prioritize your security by using advanced measures to safeguard your financial information and transactions. We are regulated by the Central Bank of Nigeria (CBN) and insured by the Nigerian Deposit Insurance Corporation (NDIC).

We recommend keeping personal and business accounts separate to ensure better financial tracking and management.

You can open multiple personal bank accounts with Bloc MFB, depending on your financial goals and needs.

You can access your Bloc MFB Personal Bank account easily through our mobile app. Click here to download the app and start managing your finances on the go.